MINE-MATCH

MINE-MATCH: Miner Identification via Nonce Expectation MAximization and Traceable Chip Heuristics

with KARIM HELMY, ALEX MEAD and KYLE WATERS

This paper was the result of a year-long collaboration between the Coin Metrics research team and mining data legend Karim Helmy.

Its major contribution is a methodology that has allowed us to determine the market share of every major Bitcoin mining machine, or ASIC, mining Bitcoin at a point in time. To do so, we analyzed nonces from blocks onchain and assessed whether they contain patterns corresponding to a large training data set extracted from real-world ASICs.

The key insight in this analysis is that Bitcoin ASICs produce patterns that are intrinsic to their respective chip designs. These patterns are clear in two integer dimensions: little-endian and big-endian. In order to make pattern identification more reasonable, we limit our search to the leading 7 bits of the nonce in both big and little-endian space.

Doing so drastically reduces the universe of possible nonce values per dimension to 2^7 or 128. Patterns are then put into “buckets” of unique possible patterns.

Every time we produce a nonce using a specific ASIC model, the 7 leading bits of that nonce will fall into 1 of the 128 distinct buckets. Through this classification method, we have found that the very same ASIC models tend to fall into the same bucket. Thus, there is a high probability that nonces produced with that pattern were produced by the identified ASIC.

With ASIC fingerprints in hand, we’re now tasked with mapping them to percentages of network hashrate. We used a technique called expectation-maximization (EM) to do this. We start with an initial guess of the distribution of ASICs, then at each time period, we look at the data and update our estimates based on the likelihood we would see this data given our current estimate. With each iteration, we eventually converge to a point within our pre-set tolerance level (0.1%) or hit the maximum number of iterations of the algorithm.

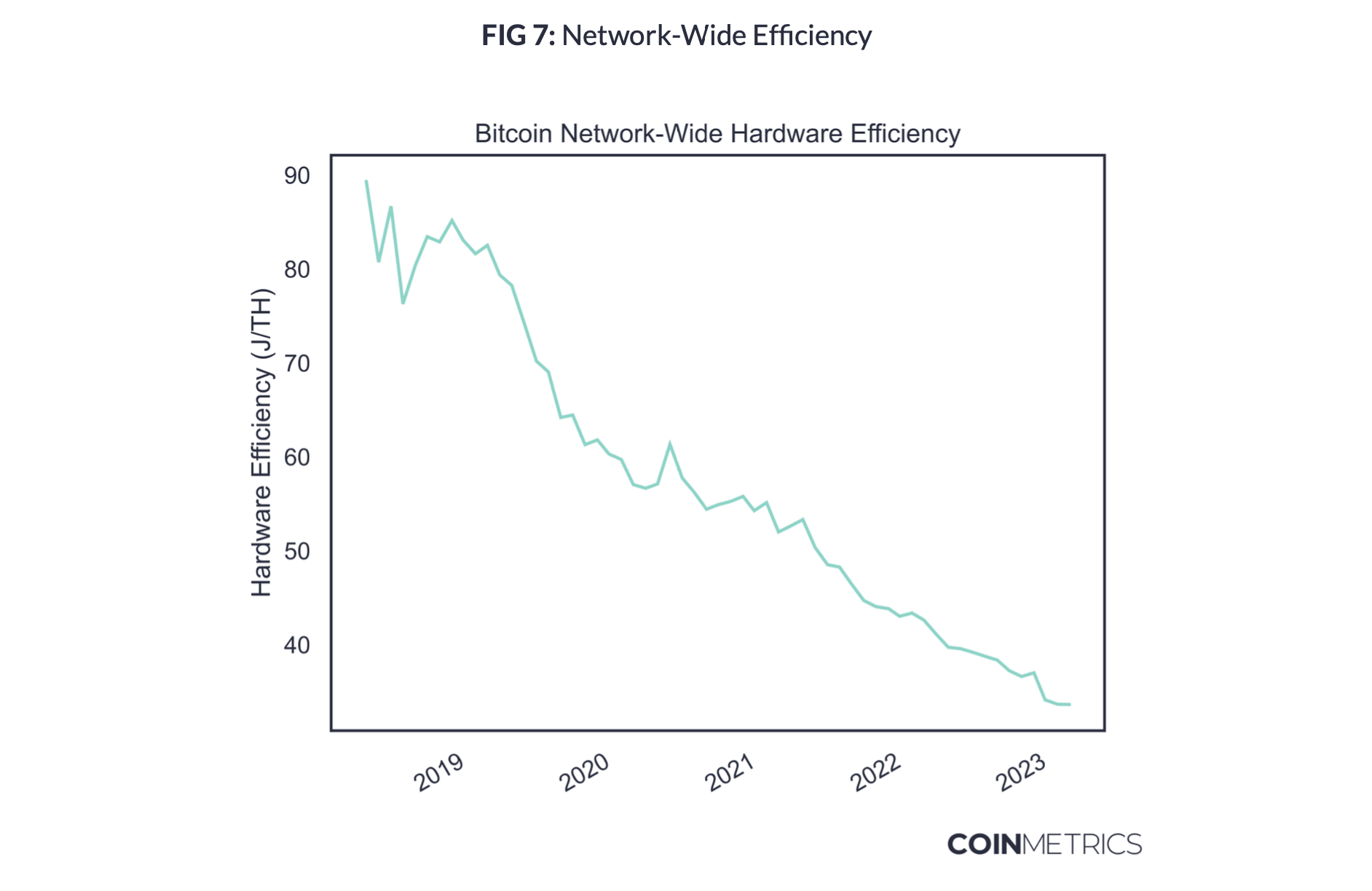

Bitcoin mining rigs vary substantially in the amount of hashpower they produce per watt of electricity: as a general rule, newer models are more efficient than older ones. With our estimates for the occurrence of each hardware model, it’s straight-forward to estimate a network-wide average efficiency by multiplying the distribution by manufacturer-specified hardware performance, giving us an average value in J/TH

To derive an energy consumption estimate, we simply multiply the network-wide average efficiency by network hashrate. We also include Power Usage Effectiveness (PUE) factors of 1.20 (upper bound), 1.10 (average case) and 1.01 (lower bound) in our calculations, matching the figures used by Cambridge. We estimate the network’s power draw at roughly 13.4 GW, or about 16% less than Cambridge’s estimate of 15.9 GW for the month of May 2023, the latest data available.

This newer methodology has several advantages over the existing body of research, including the Cambridge Bitcoin Electricity Consumption Index. Because these new results include a model hardware composition, the resulting energy consumption figures are also substantially more accurate than existing estimates. The model is the first that doesn’t factor in the price of bitcoin as an input, which renders it much less volatile; it also doesn’t require a network-wide energy price as an input, which is an oversimplification and can be difficult to estimate.

There are a lot more details covered in the full report so make sure to check it out on Coin Metrics.